Introduction

Taxation

Taxation is a system in which the government collects tax from individuals and businesses and later this money is used to improve public governance and economy. It also plays an important role in keeping the economy stable and in wealth distribution.

In this article, we will discuss in detail about the meaning, types, and importance of taxation. And after reading the article, you will also download taxation definition PDF.

What is Taxation? (Taxation Definition)

Taxation

Taxation is a system in which the government collects tax from individuals and businesses and later this money is used to improve public governance and economy.

Simple Definition:

Taxation

If you understand the definition of Taxation in simple words then it will be like this,

You can understand that taxation is a process in which the government takes money from individuals and businesses in different ways to stabilize the financial condition of its country.

In Economics & Government:

Taxation

Taxation is an important tool to stabilize the economy, control income inequality, and fund public services

Importance of Taxation

Taxation

Taxation is an important tool for government revenue and also for economic stability and to fund services.

Government Funding:

Taxation

Government collects taxes from individuals and businesses to fund public services like healthcare, education, and infrastructure

Economic Stability:

Taxation

- Taxes also help in stabilizing inflation and financial growth of any country

Public Welfare:

Taxation

- Government funds roads, hospitals, and welfare programs through taxes

Wealth Redistribution:

Taxation

- It helps in reducing the economic gap between rich and poor people

Types of Taxation (Types of Taxation)

Taxation

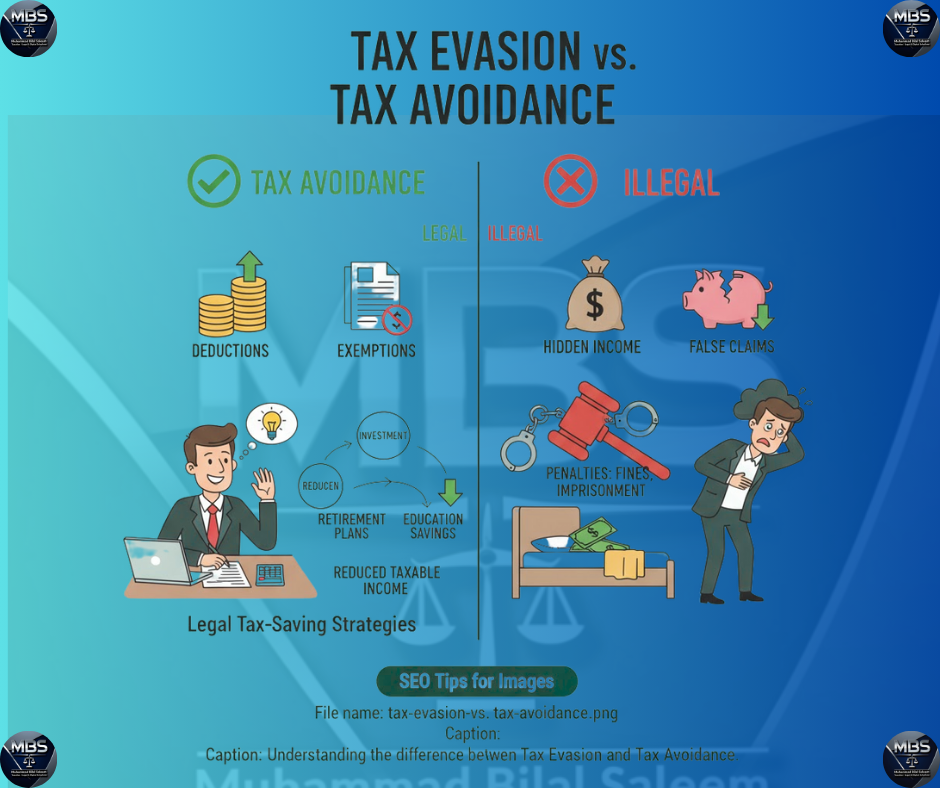

There are two main types of taxation: Direct Tax and Indirect Tax.

1. Direct Tax

Taxation

This tax is levied on income or property, which goes directly to the government.

✔ Income Tax

✔ Corporate Tax

✔ Property Tax

2. Indirect Tax

Taxation

This tax is levied on goods or services, which people pay during purchase.

✔ GST (Goods & Services Tax)

✔ Sales Tax

✔ Excise Duty

Both these taxes help in keeping the country’s economy stable

Taxation in Economics (Taxation Definition in Economics)

Taxation

In Economics, taxation helps to generate revenue and grow the economy.

Economic Growth:

Taxation

Taxes help in developing infrastructure and industries.

Inflation Control:

Taxation

- High taxes reduce the money supply and control inflation.

Wealth Redistribution:

Taxation

- Progressive tax reduces the gap between the rich and the poor.

Market Stability:

Taxation

- Tax policies help to control consumer spending and investment.

Taxation by Governments (Taxation Definition Government)

Taxation

The government collects taxes to fund public services and stabilize the economy.

Revenue Generation:

Taxation

- Funds for education, healthcare, and infrastructure.

Economic Control:

Taxation

- Managing inflation and investment by adjusting tax rates.

Public Welfare:

Taxation

- Welfare programs and subsidies for the poor.

Law Enforcement:

Taxation

- Strict rules and penalties to prevent tax evasion.

Conclusion

Taxation

Taxation is used for government revenue, economic stability, and public welfare. It improves wealth distribution and helps in supporting development projects.

I hope you have got clear concept of taxation.

Contact Us

Taxation

We’d love to hear from you! Whether you have questions, need guidance, or just want to chat about taxes (yes, it can be fun!), feel free to reach out.

Follow us on social media for updates, tips, and tax humor:

- Facebook: MBS Taxation

- Website : MBS Taxation

- Our Website Contact Form : Click Here

- Whatsapp Number : +923087543324

We’re here to simplify your taxes so you can focus on what matters most—your work, your business, and your life!