Introduction

Property rental income is a major source of income for many people in Pakistan. If your earnings are also less than rental income then you should understand the rules of Tax on rental income in Pakistan so that you do not fall into any tax trap tomorrow. In this article, I will tell you what are the rules of Tax on rental income in Pakistan and we will also discuss new updates.

Understanding Rental Income Tax in Pakistan

If you are still thinking that there is no tax on rental income in Pakistan, then congratulations, you are wrong, in Pakistan tax is levied on rental income. Now our tax system, the Federal Board of Revenue (FBR) directly classifies this rental income as tax. Now, suppose you have given a property on rent and now you are getting income from it, then the government levies tax on this income which is based on different slabs and conditions.

Tax Rates and Slabs for 2024-25

There are different tax slabs for rental income in Pakistan which apply according to the income level. Every year the government introduces new tax slabs and rates. The latest slabs for Tax on rental income in Pakistan 2024-25 could be something like this:

- If your rental income is less than a certain threshold, you can get a tax exemption.

- High rental earnings attract a progressive tax rate.

- There could be different taxation rules for corporate landlords and individual landlords.

According to these slabs, you have to properly calculate your rental income so that your tax liability can be determined correctly.

Withholding Tax on Rental Income in Pakistan

Withholding tax is a tax that is deducted on rental payments and the tenant or authorized entity pays this tax directly to FBR. It simply means that from the time you receive rent income, a specific percentage of tax is deducted from it.

Withholding tax on rental income applies to both individual landlords and companies in Pakistan, but the rates can be different for these two categories.

- If the tenant is a registered company or government entity, then it will deduct withholding tax before paying rent.

- The government revises withholding tax rates every year, so landlords should keep updated information.

- If withholding tax is not deducted, then tax on rental income has to be filed manually.

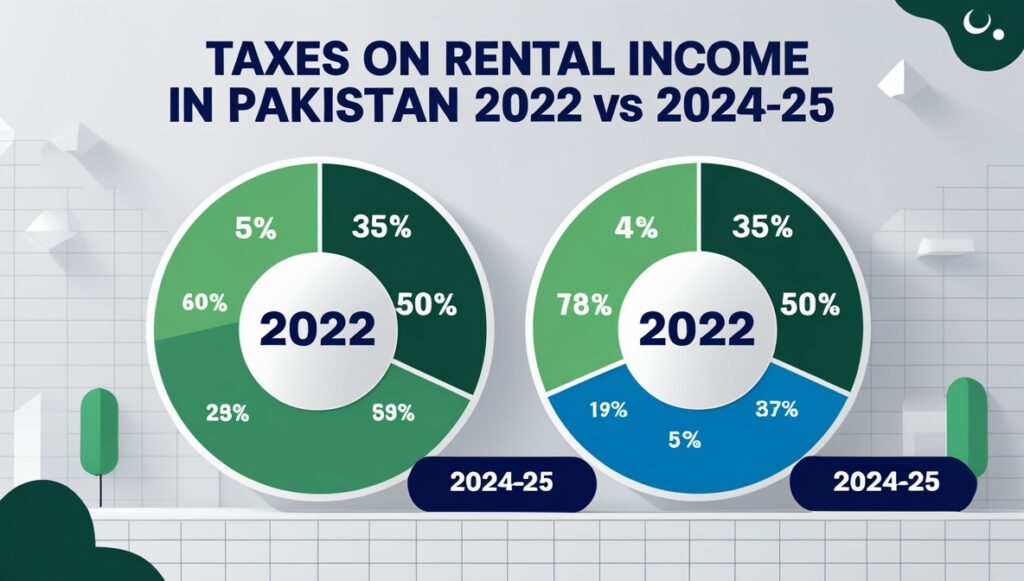

Taxes on Rental Income in Pakistan 2022 v. 2024-25: Key Differences

If now you have to compare tax on rental income Pakistan 2022 and tax on rental income Pakistan 2024-25, then why bother you, I will tell you the key differences:

- Increased Tax Slabs: Earlier, low rental income was taxed less, but as per the new rules, high-earning landlords will have to pay more tax.

- Withholding Tax Adjustments: In 2022, withholding tax rates were comparatively lower, but changes have been made in these rates as per the new budget.

- Filing and Documentation: The government has made documentation and compliance strict for rental income tax filers so that tax evasion can be controlled.

Conclusion

Tax on rental income is an important financial responsibility in Pakistan that every landlord must understand. Understanding the new tax rules and withholding tax policies and ensuring compliance is a must for every property owner. If you file taxes timely and maintain proper documentation, you can avoid unnecessary penalties and legal complications. If you have any confusion regarding rental income tax, take the help of a professional tax consultant so that your tax filing process can be completed smoothly.

Paying tax on rental income is an important requirement, and through compliance, you can ensure both your financial stability and legal security!

Contact Us

Role of the FBR in Cracking Down on Tax Fraud

We’d love to hear from you! Whether you have questions, need guidance, or just want to chat about taxes (yes, it can be fun!), feel free to reach out.

Follow us on social media for updates, tips, and tax humor:

- Facebook: MBS Taxation

- Website: MBS Taxation

- Our Website Contact Form: Click Here

- Whatsapp Number: +923087543324

We’re here to simplify your taxes so you can focus on what matters most—your work, your business, and your life!

FAQs

Is rental income tax different for residential and commercial properties in Pakistan?

Yes, rental income tax can vary based on the type of property. Generally, both residential and commercial rental income are taxable under the same basic framework, but commercial properties often have higher withholding tax rates. Additionally, corporate tenants renting commercial spaces may be required to deduct withholding tax before making rental payments, whereas individual tenants in residential properties may not have the same obligation. Always check the latest FBR regulations to ensure compliance.