Introduction

In Pakistan, taxes are given to the government by collecting revenue.

This money is used to fund sectors such as infrastructure, education, healthcare and defense.

These taxes are collected by the Federal Board of Revenue (FBR)

In this article, we will understand the tax system of Pakistan, discuss its types and payment process.

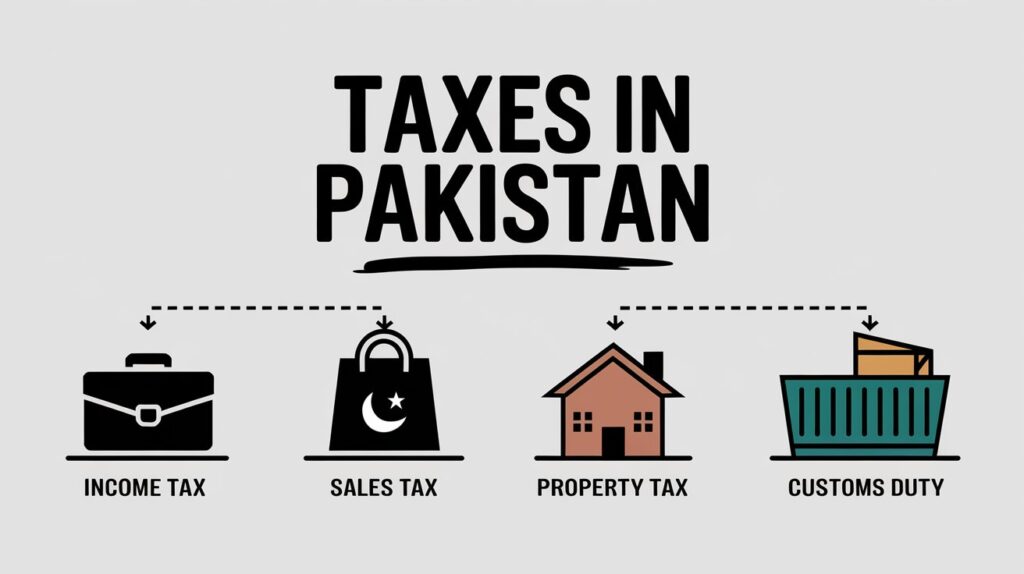

Types of Taxes

Two major types of Pakistan taxes exist:

Direct Tax

income tax

Corporate Tax

Property Tax

Indirect Tax

Sales Tax

GST

Custom Duty

Income Tax

Income Tax in Pakistan is a direct tax which is levied on the income of people and businesses.

Income Tax

Salaried Individuals

Business Owners & Freelancers

Tax Slabs

Filer vs Non-Filer

In Pakistan, the difference between Filer and Non-Filer is based on tax compliance.

Whenever someone files their tax returns on time, FBR includes them in the Active Taxpayer List (ATL)

Filer – Those who are registered with FBR and file tax returns every year.

Non-Filer – Those who do not file tax returns, more withholding tax is taken from them

Tax Registration

It is mandatory for every individual and business in Pakistan to register for tax so that they pay less tax.

You can easily get NTN (National Tax Number) from FBR’s IRIS portal, after which you can become a tax filer.

Step 1: Create an account on FBR’s official website (iris.fbr.gov.pk).

Step 2: Enter your personal and business details.

Step 3: Upload required documents and submit application.

Step 4: After the registration is approved, your NTN is issued.

Common Issues

Here are some common issues that people face during tax filing and registration:

- NTN Verification Issue

- IRIS Portal Errors

- Incorrect Tax Calculation

- Delayed Refunds

If you face these issues, you can take help of FBR helpline, tax consultant, or official guidelines to get your issues resolved and do hassle-free tax filing

Benefits of Paying Tax

Economic Growth – With the help of taxes, the economy of the country grows and new projects get funded.

Public Services – Services like education, healthcare, and infrastructure are also funded by the money collected from taxes.

Filer Benefits – People who are included in the active taxpayer list (ATL) pay less tax and get legal benefits.

It is the responsibility of all of us to pay tax and we should fulfill this responsibility so that the economy of our country grows.

Conclusion

Paying tax in Pakistan is not just a legal obligation, but with its help our country’s economy grows and our country also grows directly because of it, so we have to fulfill our responsibility.

If you are an active filer then you will get many benefits while those who are non-filers have to pay more taxes.

If you are not a tax filer yet, then you should become a tax filer now and fulfill your responsibility because in the end it is we who benefit from it.

Contact Us

We’d love to hear from you! Whether you have questions, need guidance, or just want to chat about taxes (yes, it can be fun!), feel free to reach out.

Follow us on social media for updates, tips, and tax humor:

- Facebook: MBS Taxation

- Website : MBS Taxation

- Our Website Contact Form : Click Here

- Whatsapp Number : +923087543324

We’re here to simplify your taxes so you can focus on what matters most—your work, your business, and your life!

Pakistan me tax kaise register karein?

FBR IRIS portal par online register karein aur filer banein.