Income Tax vs Sales Tax in Pakistan – Key Differences Explained

🧾 Introduction

In Pakistan, taxation is an important part of the national economy, which is government operations and financing of public services. Two of the most common types of taxes that individuals and businesses face are income tax and turnover tax.

While both work as sources of income for the government, these taxes vary greatly how they apply, who pays them, and when they are paid.

It is necessary for officials, owners of small businesses and even freelancers, to understand the difference between income tax versus turnover tax, avoid compliance, avoid penalties and make better financial decisions.

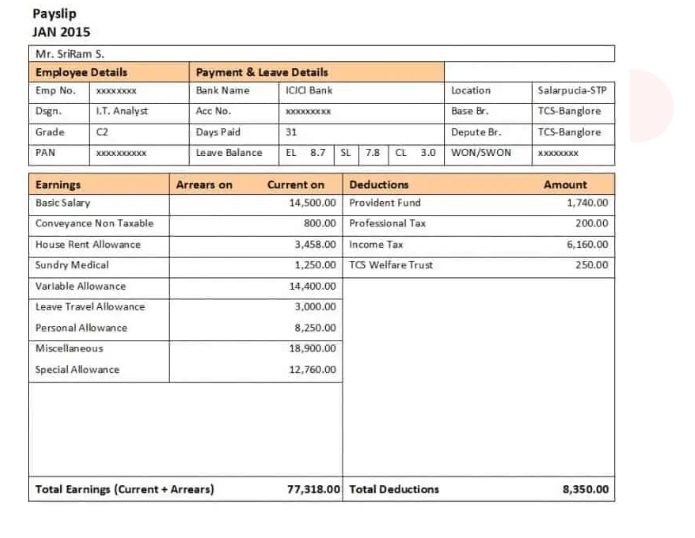

💼 What is Income Tax?

Income tax is a direct tax imposed on the income or profits to individuals and companies. Pakistan is governed by the income tax regulation, 2001 and managed by the Federal Revenue Board (FBR).

Any person who earns a certain income limit – whether an official employee, freelancer or entrepreneur – is legally necessary to pay income tax and file a return.

💡 Example of real life:

A salaried personal earnings PKR 150,000 per month falls within a specific tax rule. According to 2025 the tax rates, they must submit tax returns and pay taxes then – whether it is cut or paid independently of the employer.

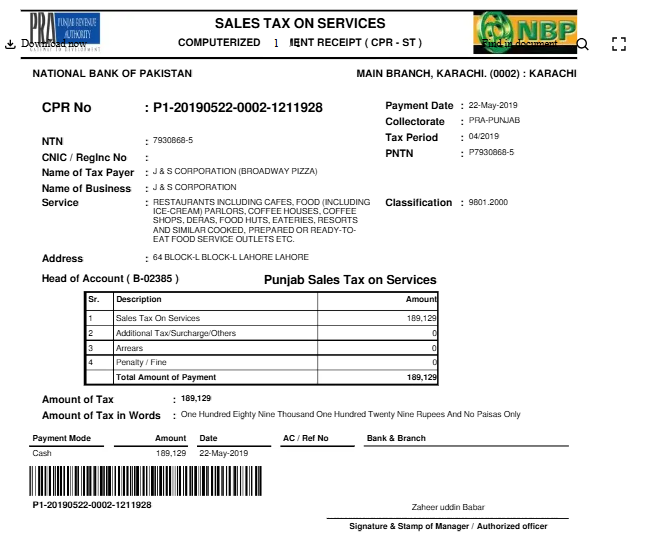

🛍️ What is Sales Tax?

VAT tax is an indirect tax that is imposed on the sale of goods and services. Instead of paying the government directly by the consumer, it is collected by the seller and then sent to FBR.

This tax sale is decided by the Tax Act, 1990. The standard turnover rate in Pakistan is usually between 15% to 17% depending on the product and the province.

💡 Example of real life:

A restaurant releases a bill of PKR 2000 and adds 15% turnover fees – to reach PKR 2,300. The restaurant collects taxes and collects PKR 300 with FBR through monthly submission.

🔍 Key Differences Between Income Tax and Sales Tax

Here’s a clear comparison of income tax vs sales tax in Pakistan:

| Factor | Income Tax | Sales Tax |

| Type | Direct Tax | Indirect Tax |

| Paid By | Individuals, businesses | Consumers (collected by businesses) |

| Basis | Income or profit | Sale of goods/services |

| Filing | Annually (some cases monthly for businesses) | Monthly or quarterly |

| Legal Law | Income Tax Ordinance, 2001 | Sales Tax Act, 1990 |

| Collected By | FBR via IRIS portal | FBR + Provincial Tax Authorities |

📚 Real-life Examples Explained

Let’s look close how every tax affects real people and businesses in Pakistan:

Example 1: Income Tax

Ali, a software engineer who earned a PKR 150,000/month, is required to submit an annual tax return. Their employer cuts taxes at the source, but Ali still needs to archive through the FBR IRIS portal to stay on the active taxpayer list (ATL).

Example 2: Sales tax

Sarah, the owner of a small cafe, charges 15% sales tax at each bill. If the total PKR for the customer is 2000, the final Challan will be 2,300. Sara must send this tax monthly to FBR by using tax returns.

In both cases, the National Identity Card (NIC) plays a role in the position of taxation and submission.

🖼️ Photo Suggestion #5: Side-by-side image of salary slip and restaurant bill

👥 Impact on Individuals & Businesses

For Individuals:

- Income tax directly affects your technological pay.

- You may be eligible for reimbursement, discount or tax credit under certain conditions.

- Being a file, you get the benefits such as low restriction, fast visa processing and loan approval.

- For Businesses:

- Both taxes must be handled – income tax on profits and sales tax on services sold.

- It is necessary to register with FBR, maintain items and regular file returns.

- Non-transport can lead to fines, revisions or even blacklisting from ATL.

🧾 Legal Compliance & Filing Process

The annual income tax has been submitted through the FBR IRIS portal. Individuals must create an account, fill the income details and submit the return by the due date each year.

For turnover tax, registered companies will have to submit monthly returns through FBR’s e-philosis system. They are also responsible for maintaining the correct invoices and records.

✅ Final Thoughts & Why It Matters

Understanding the difference between income tax versus turnover tax is important for everyone to serve or use in Pakistan. Knowing how these treasures work help you stay in accordance with law, reduce financial risks and benefit from state incentives.

Whether you are employed or an entrepreneur, tax awareness is the financial authority.

📣 Call-to-Action (CTA)

“Need help with income tax or sales tax filing in Pakistan? Contact us today for expert guidance or visit the official WhatsApp Me for tutorials, forms, and updates.