Introduction

Income tax is a mandatory tax that has to be paid by business entities and individuals on their income. Collection of income tax is done by the Federal Board of Revenue (FBR) of Pakistan according to the current tax slabs and regulations.

The tax slabs of income tax, its computation, and exemption rules are all very important to taxpayers so they remain in compliance and avoid penalties.

In this article, we will be discussing income tax in Pakistan, the new income tax slabs for 2024-25, and how to compute your taxable income.

What is Income Tax?

Income tax is a direct tax levied by the government on the income of an individual or business. The government uses the revenue raised to finance public amenities such as infrastructure, education, and healthcare.

Key Features of Income Tax:

Direct tax on income

Used for public services

Paid annually

Income Tax Slabs 2024-25 in Pakistan

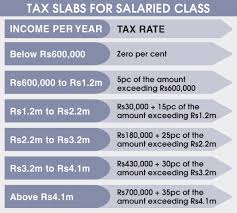

The income tax slabs are revised annually by the Government of Pakistan based on financial conditions. Below are the latest tax slabs for salaried individuals for FY 2024-25:

| Annual Income (PKR) | Tax Rate |

|---|---|

| Up to 600,000 | 0% (Tax Exempt) |

| 600,001 – 1,200,000 | 2.5% of the amount exceeding 600,000 |

| 1,200,001 – 2,400,000 | 12,000 + 12.5% of the amount in excess of 1,200,000 |

| 2,400,001 – 3,600,000 | 162,000 + 20% of the amount in excess of 2,400,000 |

| 3,600,001 – 6,000,000 | 402,000 + 25% of the amount over 3,600,000 |

| 6,000,001 – 12,000,000 | 1,002,000 + 32.5% of the amount over 6,000,000 |

| Over 12,000,000 | 2,952,000 + 35% of the amount over 12,000,000 |

Note: These tax rates apply only to salaried individuals. Business and corporate tax rates may differ.

How to Compute Income Tax in Pakistan?

To compute your income tax liability, follow these steps:

Calculate Taxable Income – Compute total income from salary, business, or investments.

Use the Tax Slab – Find your income range in the tax slab table.

Exclude Exemptions & Allowances – Deduct medical expenses or investment allowances.

Compute Tax Payable – Use the tax formula to find your exact tax.

Example Calculation:

If your gross income is PKR 1,500,000, your tax will be:12,000 + (12.5% of 300,000) = PKR 49,500

Who is Required to Pay Income Tax in Pakistan?

The following individuals and businesses must submit income tax returns in Pakistan:

Individuals earning above PKR 600,000 per year

Self-employed individuals & business owners

Companies & corporations

Property owners receiving rental income

Freelancers & online entrepreneurs

How to File Income Tax in Pakistan?

Filing income tax is now easy with FBR’s online system. Follow these steps:

Step 1: Register on the IRIS Portal of FBR (iris.fbr.gov.pk)

Step 2: Enter Personal & Income Details

Step 3: Calculate Your Tax using FBR’s Tax Calculator

Step 4: Pay the Tax Online

Step 5: Submit Your Tax Return Before the Deadline

Penalties for Not Filing Income Tax

If you fail to file your income tax, you may face the following penalties:

Higher Tax Rates – Non-filers pay extra withholding tax on bank transactions, property purchases, and vehicle registrations.

Excessive Fines – Late or non-filers can be fined up to PKR 40,000.

Legal Action – FBR can freeze bank accounts in case of tax evasion.

Conclusion

Income tax is an essential financial responsibility that helps the government provide better services. With the new tax brackets for 2024-25, it is important to:

Stay informed about your tax obligations

Accurately calculate your taxable income

File your tax returns on time to avoid penalties

If you earn above the exemption limit, register on FBR’s IRIS system and become a compliant taxpayer in Pakistan.

FAQ

How do I check whether I am a tax filer in Pakistan?

You can check your tax status on FBR’s Active Taxpayer List (ATL) by entering your CNIC or NTN number on the FBR website.

Contact Us

We’d love to hear from you! Whether you have questions, need guidance, or just want to chat about taxes (yes, it can be fun!), feel free to reach out.

Follow us on social media for updates, tips, and tax humor:

- Facebook: MBS Taxation

- Website : MBS Taxation

- Our Website Contact Form : Click Here

- Whatsapp Number : +923087543324

We’re here to simplify your taxes so you can focus on what matters most—your work, your business, and your life!