Introduction

How to Register as a Tax Filer in Pakistan (2025 Updated Process)

In today’s Pakistan, there is not just one responsibility – there is an entrance for many financial and legal benefits. Whether you are an official, business owner, freelancer or entrepreneur, listed on the active taxpayer list (ATL) created by the Federal Board of Revenue (FBR), which can save you from punishment, can increase your credibility and open doors to authorities and banking services.

In 2025, FBR introduced a better and more streamlined online process to register as a tax film. This guide runs you through all the things you need to know – from the selection criteria to completing the registration, and ensuring that you can navigate this process of self -confidence.

Understanding Tax Filing in Pakistan

- A tax film in Pakistan is a person or unit listed on the active taxpayer list (ATL) to FBR, which is updated weekly. Submission of tax returns makes you file after tax – whether your income is taxable or not.

The benefits of becoming tax films:

- Lower tax deductions for bank transactions, acquisitions of vehicles and property agreements.

- Access to bank loans and credit cards.

- Qualification for state tenders, schemes and grants.

- Improves financial reliability in both private and public sectors.

Eligibility Criteria

To become tax films in 2025, you must meet the specific criteria mentioned by FBR.

Who will sign up:

- A person earning PKR 600,000 per year.

- Company owner or self -employed, regardless of income level.

- Freelancers or digital workers serving from local or foreign customers.

- Property owner with rental income.

- Non-residents who have income from Pakistan.

Note: Even if your income is below the taxable limit, it is recommended to register and file your returns to appear on the ATL.

Step-by-Step Guide to Registration

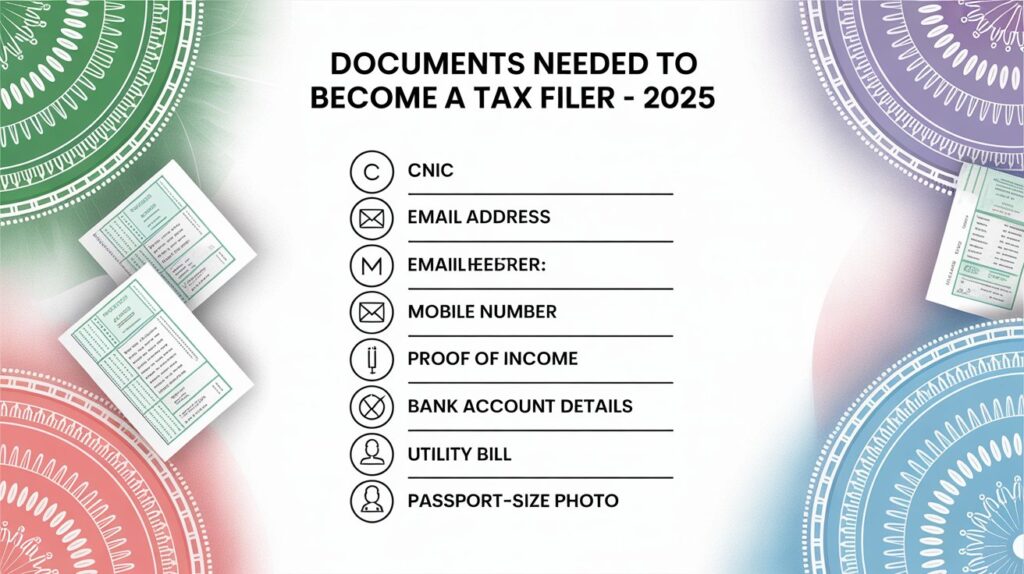

Step 1: Gather Necessary Documents

Before starting your registration, keep the following documents ready:

- CNIC (Computerized National Identity Card)

- Mobile number registered with your CNIC

- Active email address

- Proof of income (salary slips, business statements, freelance invoices)

- Bank account details

- Utility bills for address verification

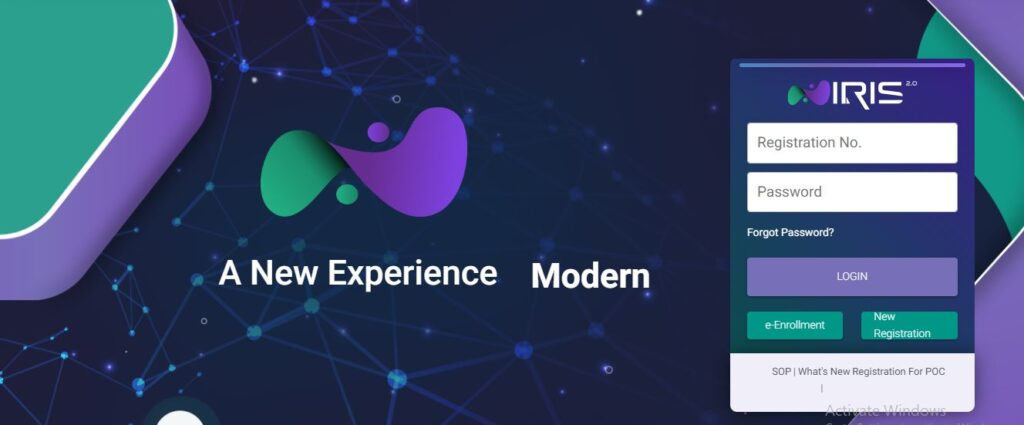

Register Online Through FBR Website

- Visit the FBR’s official portal.

- Click on “Registration for Unregistered Person.”

- Fill out the basic information form (CNIC, name, contact info).

- Create your IRIS account by verifying with OTP sent to your mobile/email.

- Once logged in, complete the Registration Form (181):

- Personal details

- Source of income

- Address and contact information

- Personal details

- Submit the form and wait for confirmation.

Step 3: Verification Process

- FBR will verify your documents and credentials via their back-end systems.

- You may receive a call or SMS for verification, especially if details are incomplete.

- In some cases, manual verification at your nearest Regional Tax Office (RTO) may be required.

Step 4: Confirm Your Filer Status

- After successful registration, login to IRIS and submit your Income Tax Return (ITR).

- Once your return is filed, your name will appear in the Active Taxpayer List (ATL) the following week.

- You can check your ATL status at: https://www.fbr.gov.pk

Common Challenges and Solutions

| Problem | Solution |

| OTP not received | Check CNIC-linked number; contact 051-111-772-772 |

| Error in IRIS form | Use Google Chrome; clear browser cache |

| Not appearing in ATL after filing | Wait for next weekly update; ensure return was accepted |

| Unclear income proof for freelancers | Attach invoices or payment screenshots with ITR |

Conclusion

For 2025, it has never been easy to register as a tax film in Pakistan – better FBR IRIS platform and thanks to simplified verification methods. Whether you aim to save money, expand your business or complete your social tasks, archive the return and get into the active taxpayer list provides long -term benefits.

🎯 Don’t wait — gather your documents and register today

Got questions or stuck during registration? Share your experience in the comments below or reach out to our team at mbstaxation.com for free guidance!