Introduction

If you are using a mobile phone imported from abroad that is not registered in Pakistan, you must check its PTA tax. The PTA has introduced a new system, DIRBS, which confirms that only mobile phones legally imported into Pakistan should work on Pakistan’s network. If you want your mobile to work properly on Pakistan’s network, you will have to get PTA tax verification done.

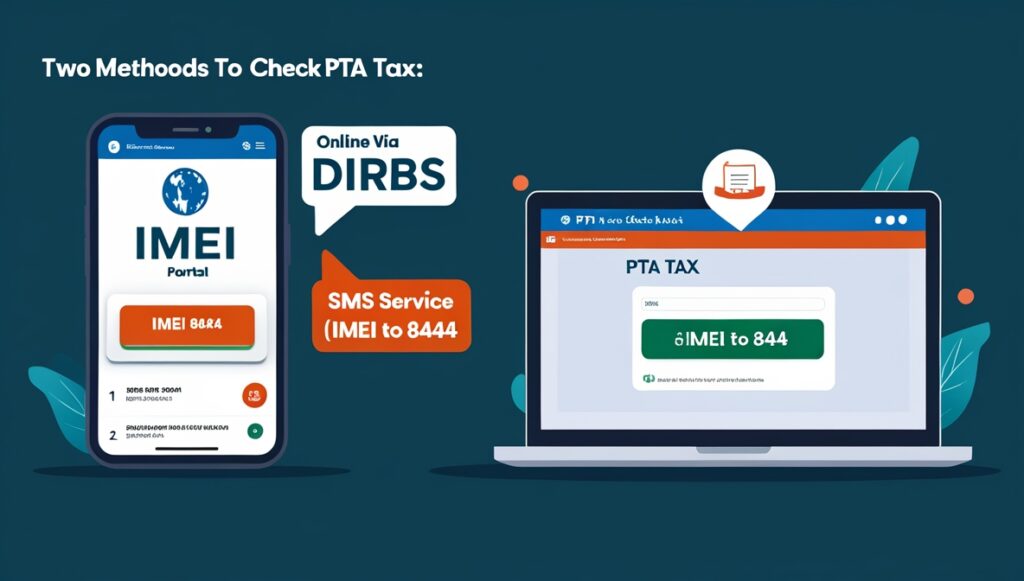

Methods to Check

You can easily check PTA tax online or through SMS. Both methods are explained below:

1. Checking Tax from PTA Official Website

If you want to check PTA tax of your mobile online, then follow these steps:

- Note down the IMEI number of your mobile (dial *#06# and save the IMEI number).

- Visit PTA’s DIRBS portal (https://dirbs.pta.gov.pk/).

- Enter the IMEI number there and press the “Check” button.

- Your tax details and registration status will be shown on the screen.

If your device is non-registered, the tax amount will also be mentioned there, which you have to pay so that your mobile is not blocked.

2. Check PTA Tax through SMS

If you do not want to use the online portal, you can also check PTA tax through SMS service.

- Check your phone’s IMEI number (dial *#06#).

- SMS the IMEI number to 8484.

- After some time you will get a reply SMS which will tell you the PTA registration status of your mobile and the required tax amount.

This method is very easy and fast, and you can verify the PTA tax of your mobile even without internet.

Why Checking PTA Tax is Important?

If you do not check PTA tax and do not pay it on time, you may have to face a lot of problems. Below are some major benefits that you get by checking PTA tax:

1. Non-Registered Phones Can Be Blocked

If your phone is not registered with PTA and you have not paid your tax, your mobile will stop working on Pakistani networks. That is why it is important that you verify PTA tax beforehand and pay it on time.

2. Legal Compliance Is Ensured

Paying PTA tax means that you are following legal compliance. If you use imported mobile phones, it is mandatory to pay tax on them so that you can avoid any legal action or penalty.

3. Avoid Fraud and Illegal Devices

One of the biggest benefits of checking PTA tax is that you can avoid using fraud or illegal phones. Sometimes smuggled and non-tax paid phones are found in the market, but when you check IMEI from PTA, you get to know whether the mobile is legally registered or not.

Conclusion

Checking PTA tax is important for every mobile user, especially those who use imported or non-registered phones. If you want your mobile not to be blocked and legally registered with PTA, then check your tax from PTA DIRBS portal or SMS service and if necessary, pay tax timely.

Contact Us

We’d love to hear from you! Whether you have questions, need guidance, or just want to chat about taxes (yes, it can be fun!), feel free to reach out.

Follow us on social media for updates, tips, and tax humor:

- Facebook: MBS Taxation

- Website: MBS Taxation

- Our Website Contact Form: Click Here

- Whatsapp Number: +923087543324

We’re here to simplify your taxes so you can focus on what matters most—your work, your business, and your life!

What happens if I don’t pay my PTA tax?

If you don’t pay your mobile tax, your mobile phone may get blocked on all Pakistani networks, meaning you won’t be able to make calls, send messages, or use mobile data.