Introduction

Free Income Tax Calculator Pakistan – 2025 Salaried Person Edition

Income tax is an important responsibility for any acquired citizen of Pakistan. For salaried employees, understanding how much tax payments must be carried out, what exceptions are relevant and how you can maintain in line with changed laws, it is necessary for the correct financial plan and legal compliance.

For 2025, updating the rules for tax consoles and official Arjaks with the Federal Board of Revenue (FBR), it is more important than ever to make an accurate calculation of expected obligations. To help with this, MBS taxation is proud to offer a free income tax calculator at mbstaxation.com – especially for officials.

In this blog we will run through everything needed to know how to use this tool to effectively manage your treasures.

Overview of the Free Income Tax Calculator

The free income tax calculator at MBS taxation is an online tool designed to make tax calculation easier, quickly and accurately for Pakistan officials. Instead of manually worrying about going through tax records or updates of the FBR guidelines, users can only set their income details and immediately see their estimated tax liability for the financial year 2025.

What Does the Calculator Do?

- Uses the last 2025 tax plate issued by FBR.

- Calculates the annual tax automatically based on its monthly or annual salary.

- If applicable, adjust for a discount or cut (optional field).

- A pure, quick overview of monthly and annual tax liability.

2025 Tax Law Highlights for Salaried Individuals

Before using the calculator, it’s important to understand the changes in income tax laws for the year 2025:

| Annual Income Range (PKR) | Applicable Tax Rate |

| 0 – 600,000 | 0% (Tax exempt) |

| 600,001 – 1,200,000 | 2.5% of the amount exceeding PKR 600,000 |

| 1,200,001 – 2,400,000 | PKR 15,000 + 12.5% of the amount exceeding 1.2M |

| 2,400,001 – 3,600,000 | PKR 165,000 + 20% of amount exceeding 2.4M |

| 3,600,001 and above | Progressive up to 35% (as per FBR 2025 brackets) |

📌 The calculator on mbstaxation.com is fully aligned with these updated tax brackets.

Tax Calculator 2025-2026-Pakistan

Features of the Calculator

The Free Income Tax Calculator on MBS Taxation is more than just a tax tool — it’s a full experience designed with simplicity and accuracy in mind.

✅ Key Features:

- User-Friendly Interface – Anyone can use it without prior tax knowledge.

- Auto-Slab Adjustment – Automatically applies relevant tax rates and slabs.

- Real-Time Calculation – See results instantly after input.

- Mobile Responsive – Works perfectly on mobile and desktop.

- No Registration Needed – Use it freely without signing up.

🔐 Unique Selling Points:

- Regular updates synced with FBR circulars

- Designed exclusively for salaried individuals

- Fields for bonus income, allowances, and deductions

- Completely ad-free and secure

Benefits for Salaried Individuals

💡 Why Should You Use It?

- Save Time: No need to go through long tax guides or calculate manually.

- Avoid Mistakes: Reduces the risk of errors in estimating your tax.

- Plan Ahead: Understand how much tax you owe in advance and adjust monthly budgeting.

- Stay Updated: Reflects the latest income tax law changes and ensures you remain compliant.

📊 Ideal for:

- Private sector employees

- Government workers

- Freelancers with fixed monthly income

- Professionals receiving monthly pay through bank

Using this calculator can increase your financial confidence, especially when preparing for tax return filing, applying for bank loans, or evaluating salary offers.

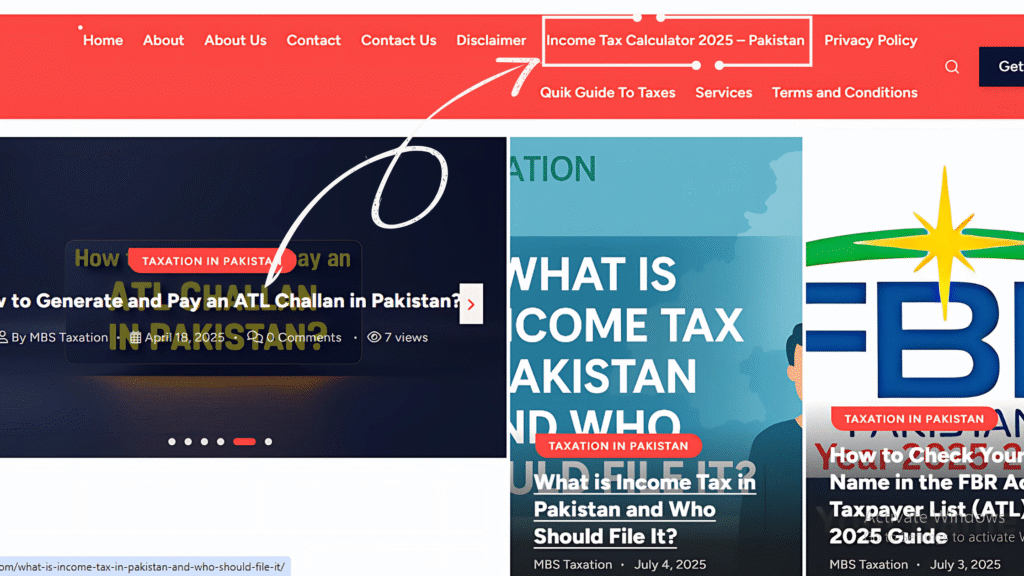

Step-by-Step Guide on How to Use the Calculator

🔧 Here’s how you can use the calculator in under 2 minutes:

- Go to: https://mbstaxation.com/income-tax-calculator

- Select “Salaried Person – 2025” from the category dropdown.

- Enter Monthly or Annual Gross Salary in PKR.

- (Optional) Input any bonuses, deductions, or tax credits you want considered.

- Click “Calculate Tax”

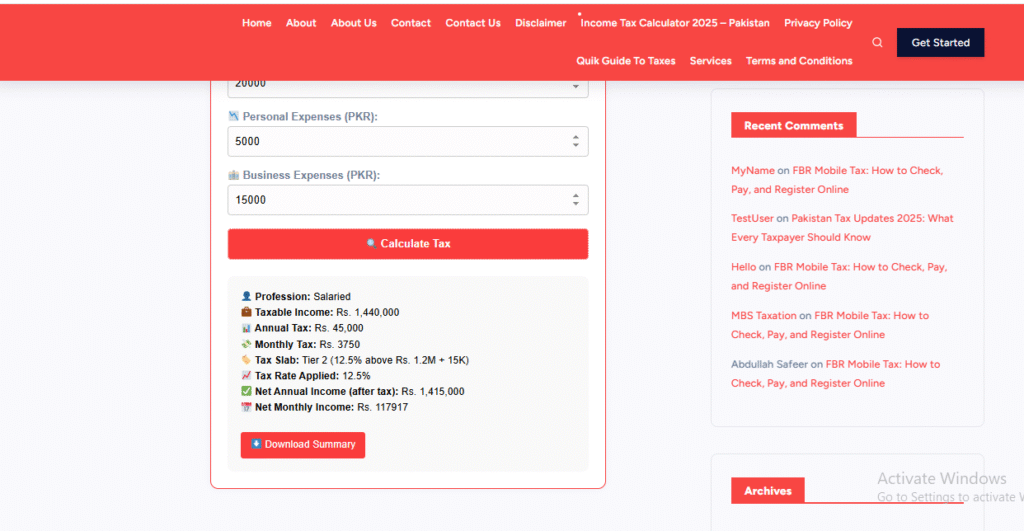

- View your:

- Monthly Tax Payable

- Annual Tax Payable

- Net Take-Home Salary (after tax)

- Monthly Tax Payable

- (Optional) Download or print the summary for record-keeping.

Free Income Tax Calculator Pakistan – 2025 Salaried Person Edition

Common FAQs

❓ Is the calculator exactly?

Yes. The calculator uses the last 2025 tax plate published by FBR and is updated to live regularly to live in accordance with legislative changes.

❓ Can freelancing or business owners use it?

This version is specially designed for officials. However, a separate calculator for freelancers and businesses will soon be added.

❓ Do I have to create an account?

No, the calculator is 100% free and open to all users-no-registration is required.

❓ Can I save my tax summary?

Yes. After calculating, you can print or save the result as PDF for documentation or later use.

Conclusion

At a time when the tax laws develop annually and confusion is common around cuts, a reliable, user -friendly income tax calculator is necessary for salaried employees in Pakistan.The free income tax calculator at mbstaxation.com is a reliable, without any cost solution to guess from your tax plan in 2025. Whether you are preparing to submit a return or just evaluate your wage package, this tool gives you the right to be informed and ready.