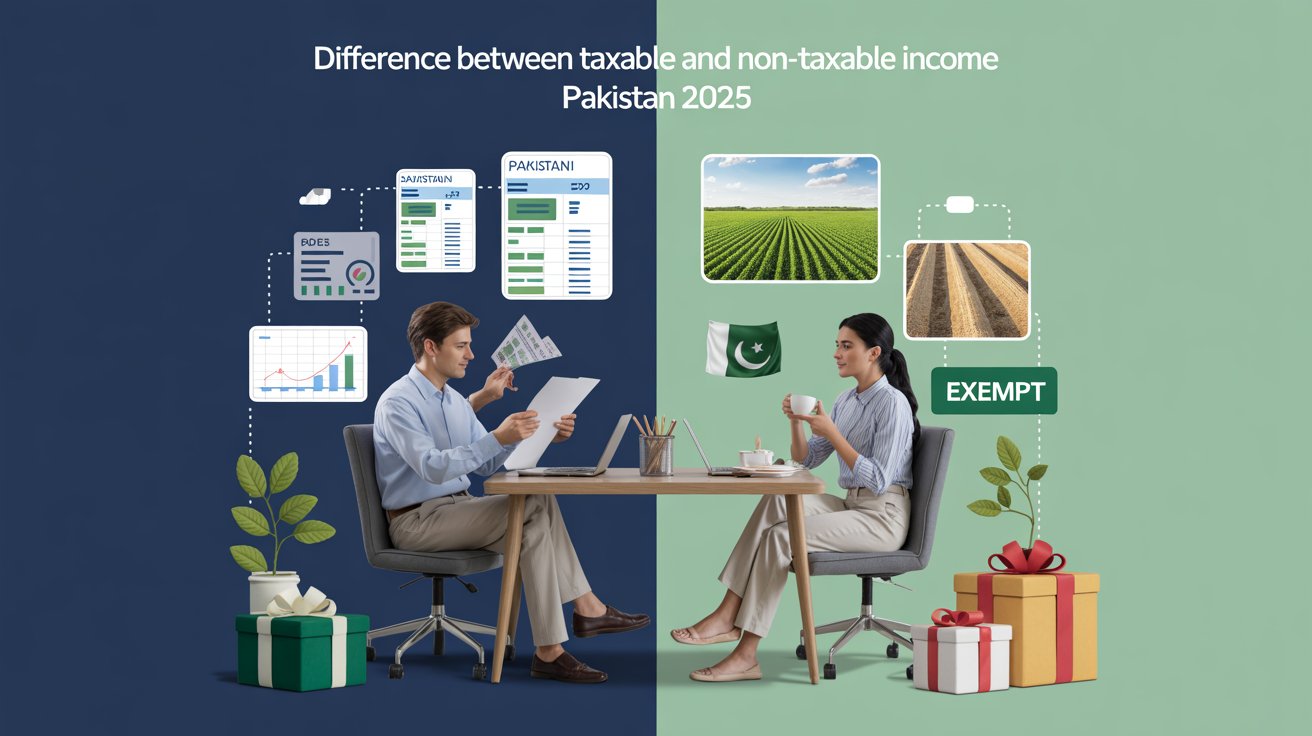

It is necessary for each Pakistani citizen to understand income taxation. Whether you are an official employee, a business owner or freelancer, and know the difference between taxable and non-taxable income, you can help you better plan finance and can help avoid legal problems with the Federal Board of Revenue (FBR).

In this post, we break everything needed to learn about taxable and non-taxable income in Pakistan, their examples, legal structure and why this difference means something to your personal or professional economy.

What is Income Tax and Why It Matters

In -Pakistan, income tax is a direct tax imposed on a person or business. It creates an important part of the country’s income, which helps with funds in public infrastructure, education, health care and national safety.

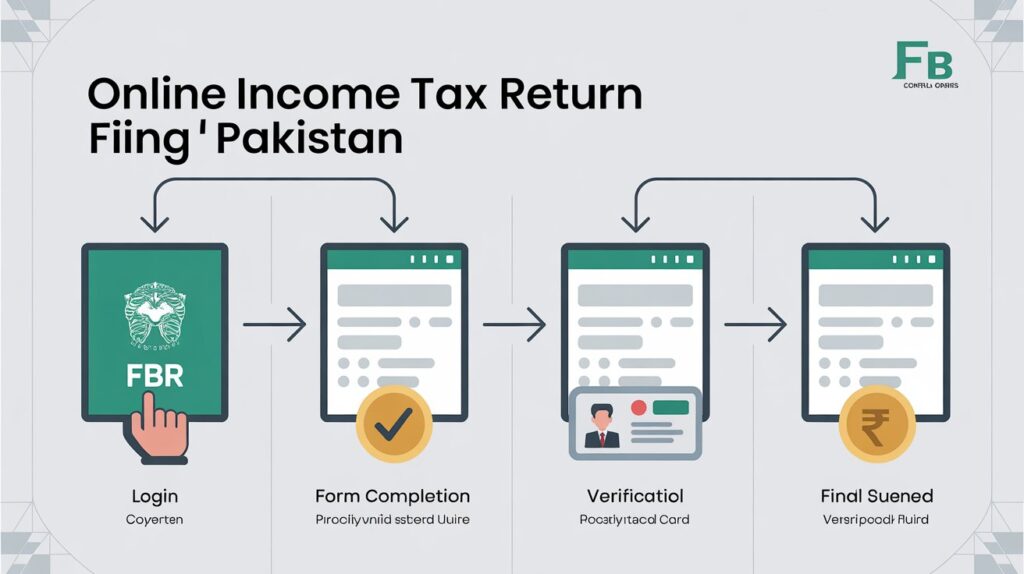

The submission of tax returns not only ensures compliance with the law, but also allows citizens to benefit from various state incentives, qualify for loans and enjoy legal protection in financial matters.

However, not all income is equally taxed-which brings us to the concept of taxable versus non-taxable income.

Taxable Income in Pakistan

✅ Definition:

Tax income refers to revenues or revenues that are legally subject to taxation in accordance with the income tax word, 2001.

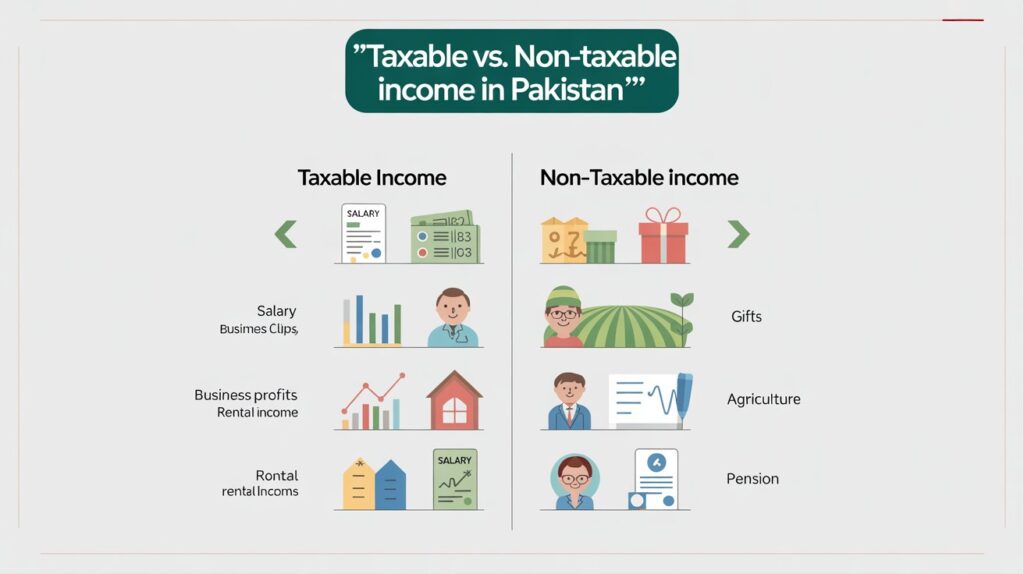

- General examples of taxable income:

- Pay Income: Monthly income from employment after adjustment for exemption

- Professional benefits: Income by conducting only ownership or partnership

- Rental income: Revenue from renting residential or commercial properties

- Capital gains: Benefits of selling stocks or properties

- Dividend income: Return on shares from companies

- Freelance or counseling income: Income earned from local or foreign customers

All of these income sections are evaluated and tax is imposed at the rates used based on tax lab or income limit.

Non-Taxable Income in Pakistan

✅ Definition:

Non-taxable income is either free of tax or not recognized as income for tax purposes.

2. Examples of non-taxable income:

- Gifts and inheritance received from blood relatives

- Agricultural income, only under provincial tax

- Pension income (for state employees)

- Scholarship or educational scholarship

- Zakat and other charitable benefits

- Some quotas such as medical allowance (below limit)

This type of income is exempt from either permanently or conditional under specific parts of the Tax Act.

Key Differences Between Taxable and Non-Taxable Income

Here is a comparison table for easy understanding:

| Feature | Taxable Income | Non-Taxable Income |

| Subject to Tax | Yes | No |

| Examples | Salary, rent, business profits, dividends | Gifts, pension, scholarships, agricultural income |

| Tax Filing Requirement | Must be declared and taxed | Often declared but not taxed |

| Record Keeping | Mandatory | Optional (but recommended) |

| Legal Implications | Non-compliance leads to penalties or audits | No penalties unless misreported |

💡 Tip: Always declare both taxable and non-taxable income in your tax return. This helps avoid suspicion during FBR audits.

Legal Framework: Income Tax Laws in Pakistan

The Main Act that controls income tax in Pakistan is the income tax word, 2001. It emphasizes that income forms punishment for acceptable discounts, archiving processes and theft.

The Federal Board of Revenue (FBR) is the central authority responsible for tax collection, revision and enforcement.

If your income comes from the annual area (PKR 600,000 for individuals in 2025), you must legally submit your tax return, even if your income rate is non-tax.

Why Understanding These Categories Matters

Failure to distinguish between taxable and non-taxable income may arise:

- Calls taxes with accidents

- Learned for the least income, penalty or FBR audit

- Tax credit

For companies, this knowledge helps to adapt to expenditure requirements, profit calculation and tax deduction.

Practical Tips for Taxpayers

- Keep records of all income sources, even non-taxable ones like gifts or pensions.

- Review FBR’s income tax slabs every year to see if you qualify for filing.

- Use official exemptions carefully — only claim what’s legally allowed.

- Hire a tax consultant or use reliable software if you have mixed income streams (taxable + non-taxable).

- Declare agricultural income even if it is not federally taxed — it improves your financial credibility.

Conclusion

Understanding the difference between taxable and non-taxable revenues in Pakistan is important in order to avoid compliance, smart tax plans and legal problems. FBR actively encourages digital filing, there is no excuse to manage your income correctly.

Whether you are an official professional or a businessman, the right income can save money, reduce stress and stay in good tax authorities.

✅ Need Help?

If you’re unsure about whether your income is taxable or not, visit mbstaxation.com or consult with one of our tax professionals for a free assessment.