By 2025, tax expertise in Pakistan will become more important than ever. Expand your database actively with the Federal Board of Revenue (FBR) and integrate technology into your system, having an Active Tax List (ATL) is not just a labeling mark – it is an entrance to many financial and legal benefits.

Whether you are an official professional, freelancer, businessman or investor, and become tax films give you a lead that non-filters do not have. This article emphasizes all the biggest benefits of being a tax film in Pakistan in 2025, and now why is the best time to register.

🧾 What Does It Mean to Be a Tax Filer in Pakistan?

A tax film is the one who submits a tax return annually and is displayed on the FBR’s active taxpayer list (ATL). This list is updated weekly and confirms that you comply with Pakistani tax rules.In 2025, the ATL status affects everything from bank transactions to vehicle registration. And the good news is – becoming a files is simple, and the benefits are enough.

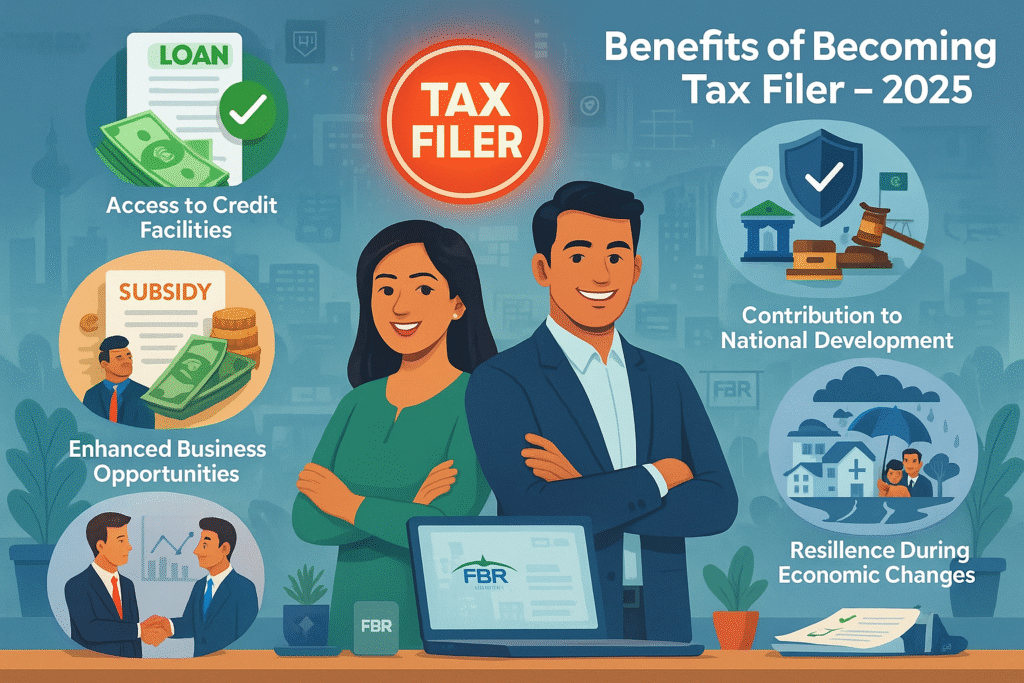

Key Benefits of Becoming a Tax Filer in Pakistan

1️⃣ Access to Credit Facilities

One of the largest tax files in Pakistan (2025) is an improvement in debt and credit to credit. Banks and financial institutions favor athlete people when:

- Individual or mortgage approval

- Edition of credit card

- Provides trade financing

Being a files shows that you have a traceable income and are financially responsible – what lenders really want to see.

2️⃣ Eligibility for Government Subsidies

- The government offers several grant programs to support housing, agriculture and energy sectors. But many of them are only available to registered and filter.

- If you are at ATL, you are more likely to qualify for it:

- Grant loan (eg Naya Pakistan Housing Scheme)

- Utility Bill discounts for small businesses

- Start -up scholarship or state -supported Enterprise Fund

3️⃣ Enhanced Business Opportunities

For entrepreneurs and owners of small businesses, to be a tax film that opens the doors:

- Qualifying to apply for tenders and contracts.

- Easy access to commercial registration and license.

- Better to stand with investors and customers

Many suppliers and B2B companies also require suppliers NTN and ATL status before they shop.

4️⃣ Legal Protection and Reduced Audit Risks

Tax filters are less likely to receive audit notice or penalties from FBR. They also like:

- Act on money laundering is less likely to be examined.

- Priority support while solving tax disputes.

- Legal clarity in sources of income and cut.

Tax submission also ensures that you are documented, which can protect your property in future legal or financial matters.

5️⃣ Contribution to National Development

When you pay taxes, you contribute to:

- Infrastructure development

- Health services and education

- Defense and national security

Your tax submission supports Pakistan’s economy – and this is a brand of citizens’ pride and responsibility.

6️⃣ Improved Personal Finance Management

To submit a tax return, you must track income, expenses and deductions that help you:

- Monitor your cash flow

- Identify unnecessary expenses

- Savings and investment schemes

This is the first step towards financial literacy and development.

7️⃣ Increased Resilience During Economic Changes

Under financial uncertainty (eg, inflation, change of policy), you give a files:

- Access to official financial assistance programs

- Reduced tax on foreign transfers

- Limited allocated in high outlets and bank

This helps protect your income and assets when the time is difficult.

🔍 Who Should Become a Filer in 2025?

Anyone earning above the taxable limit — including:

- Salaried employees

- Freelancers and consultants

- Property owners

- Online business operators

- Shopkeepers and SMEs

Even if you’re below the tax threshold, filing a return can help you establish financial credibility.

🧠 Final Thoughts

Becoming tax films in 2025 is more than a legal requirement – this is a smart financial decision. From simple loan approval to commercial development, FBR is on the active taxpayer list, there is security and new opportunities are opened.