Step-by-Step Guide to Filing Your Income Tax Return Online in Pakistan.

The submission of tax return is not just a legal obligation – it is a smart financial habit that improves your credibility, provides access to financial products and avoids punishment. With the offer of an online portal with the Federal Board of Revenue (FBR), the process has become easier than ever. This guide will drive you through a clear, step-by-step format through the online tax registration process in Pakistan.

Understanding Tax Obligations in Pakistan

In Pakistan, the following individuals and institutions must enter into tax returns:

- Personal person Rs. Earn more than 600,000 annually.

- Business owners or freelancers serve over the rupi. 400,000.

- Owner of properties receiving rental income.

- Non-residents with Pakistan-Katte income.

- Companies registered with FBR, AOPS and NGO.

Ensure the return that your name is included in the active taxpayer list (ATL), which helps to reduce tax rates and increase financial reliability.

Preparation Before Filing

Before you begin the online tax filing process, gather the following documents and data:

- CNIC Number

- Salary certificate (for salaried individuals)

- Bank account statements

- Details of investments, property income, or freelance income

- Tax deduction certificates

- Utility bills (for deductions)

- Zakat and donation receipts

- Previous year’s tax return (if applicable)

Having these on hand will make the process smoother and faster.

Step-by-Step Online Filing Process

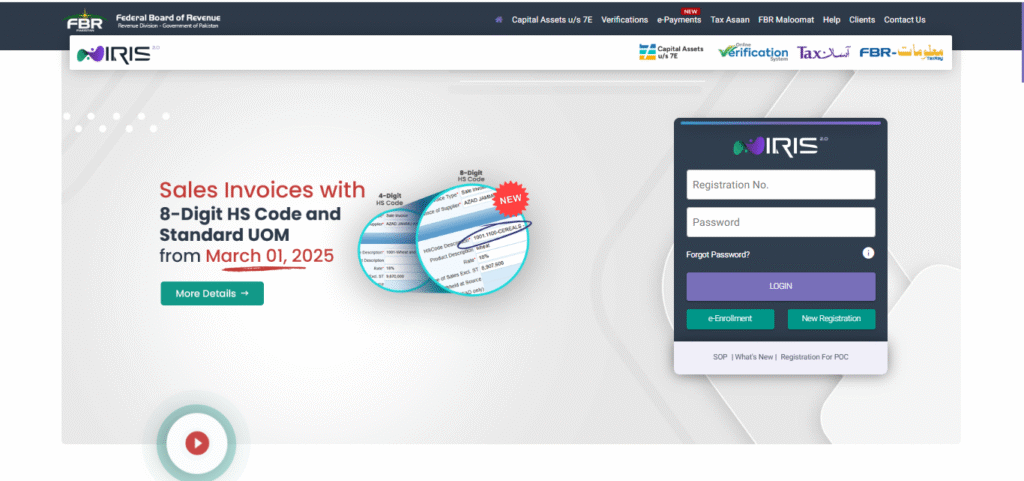

Step 1: Register on the FBR Website

- Visit https://iris.fbr.gov.pk

- Click on “Registration for Unregistered Person” if you’re new.

- Enter your CNIC, phone number, and email to receive login credentials via SMS and email.

Step 2: Login to IRIS Portal

- Use the received credentials to log into IRIS.

- You’ll be redirected to your dashboard, which shows your tax profile.

- Enter your CNIC and Password

Click on Login

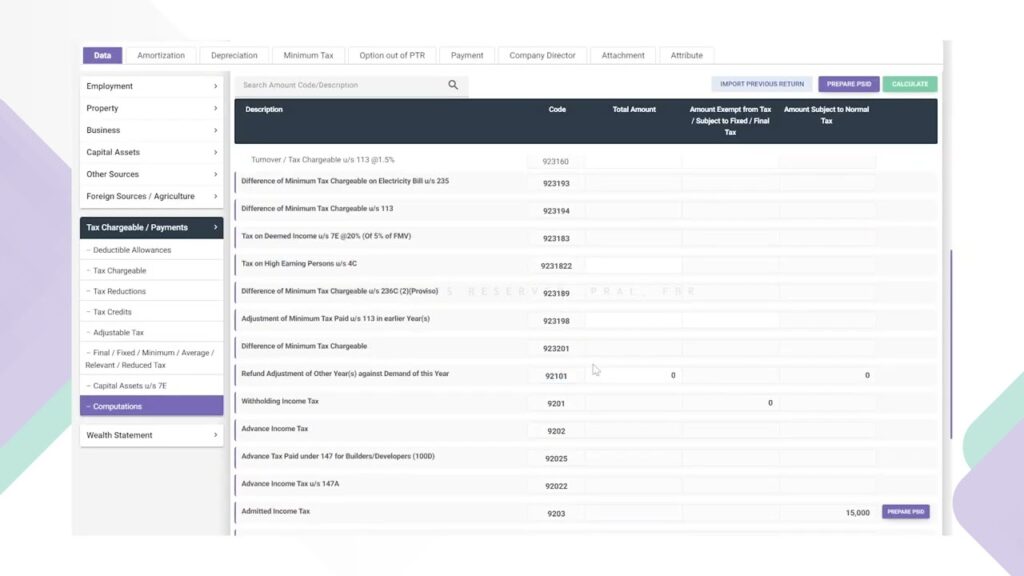

Step 3: Navigate to Income Tax Return Form

- Click “Declaration” in the top menu.

- Click on Normal Tax Return

- Choose the Tax Year (e.g., 2025).

- Select “Income Tax Return (Individuals)” under the relevant category.

Step 4: Fill Out the Return Form

- Personal Details: Pre-filled, verify accuracy.

- Employment Section: Enter salary income from your certificate.

- Other Income: Add property rent, freelance income, or business income.

- Tax Deductions: Fill in zakat, donations, investments, and medical bills (if allowed).

- Use the calculator provided for auto-calculation of your tax liability.

Step 5: Review and Submit

- Click “Validate” to ensure all fields are correctly filled.

- Then click “Submit” to file your return.

- Click On Right side last option E-Payment to get your PSID

- If you owe tax, generate a PSID (Payment Slip ID) and pay through your bank’s mobile app or ATM.

Step 6: Confirmation and Next Steps

- Once submitted, you’ll receive an Acknowledgement Receipt.

- Download or print the Income Tax Return Receipt for record-keeping.

- Ensure your name is added to the Active Taxpayer List after successful filing.

Common Mistakes to Avoid

Here are a few frequent errors in online tax filing and how to avoid them:

- ❌ Incorrect CNIC or bank details

✅ Always double-check input fields - ❌ Missing deductions or allowances

✅ Keep all receipts and proof of expenses - ❌ Filing under the wrong category

✅ Understand your taxpayer classification - ❌ Not reviewing before submission

✅ Use the preview/validate button to catch errors

FAQs on Filing Tax Returns Online in Pakistan

Q1: Is it compulsory to archive online return?

Yes, FBR requires that all qualified persons and companies enter into the tax return electronically.

Q2: What if I made a mistake after submitting?

You can submit revised returns within a certain period through the same iris portal.

Q3: Is online filing for free?

Yes, there are no fees to use FBR’s online portal, although professional help can use you.

Q4: What is the deadline for submission of return?

Usually September 30 each year. However, the FBR may extend the deadline depending on the circumstances.

Q5: How do I check if I’m in the active taxpayer list? Go: https://taxnet.fbr.gov.pk/ and enter CNIC to confirm your ATL situation.

Conclusion

The amount of submission of tax returns online is easier than what it looks like. This ensures that you are in line with Pakistani tax law, help you avoid punishment and give you access to many financial benefits. By following this step-by-step guide, you can meet the return without stress.