🟢 Introduction: Why the ATL Matters More Than Ever

How to Check Your Name in the FBR Active Taxpayer List (ATL) – 2025 Guide

In Pakistan, it is not just about avoiding punishment in accordance with the income tax rules – it is about being recognized as a responsible citizen and now valuable financial benefits. One of the most important indicators of tax compliance is listed in the active taxpayer list (ATL) to FBR.

As we go in 2025, it has never been more important to check our name in ATL. Whether you apply for bank loans, buy property, register a vehicle or work freelance, your Atl status plays a big role. This wide guide will run through how to check your ATL status, if you are not listed, what to do, and why it is important to remain obedient.

🔍 What is the FBR Active Taxpayer List (ATL)?

The active taxpayer list (ATL) is an official weekly publication of the Federal Board of Revenue (FBR) which includes the names of individuals, companies and AOPS (unions to individuals) who have submitted the tax return for the last tax year.

📌 Large brands:

- ATL is updated every Monday.

- The inclusion is based on the time of tax return.

- This confirms your “files” status, which reduces the tax and reduces more economic privileges.

Being at ATL is mainly the government’s way of confirming that you are an obedient taxpayer in Pakistan.

✅ Benefits of Being Listed in the ATL

- 🏦 Reduced tax: Tax on tax transactions, dividends and vehicles/real estate purchases.

- 📝 Professional reliability: Companies and public institutions like to work with filters by registering.

- 💳 Banking benefits: Elevated credit limit and enhanced financial service options.

- 📁 Professional Opportunity: Necessary to participate in tenders, secure government jobs and more

📘 How to Check Your Name in the ATL – 2025 Method

It’s a simple, step -by -step guide to check if your name is in FBR Atl 2025:

🧾 Necessary information:

- CNIC number (without dash) – for individuals

- NTN -Number – for companies or businesses

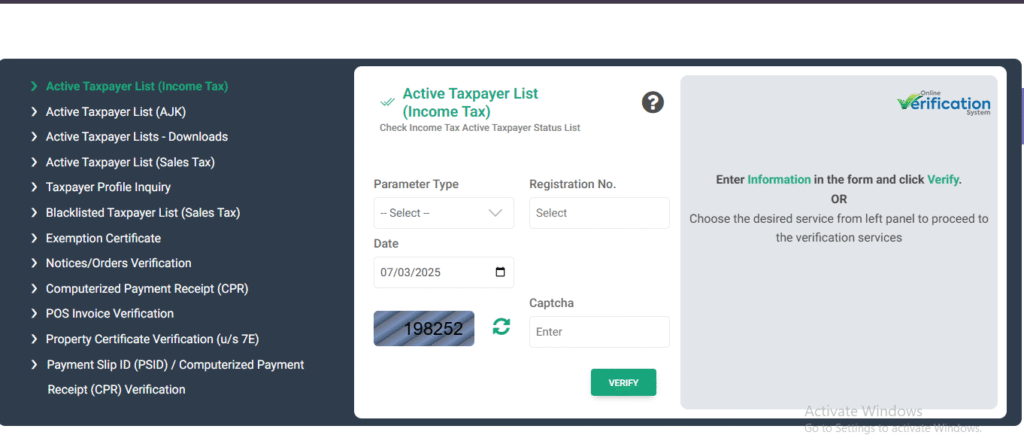

🌐 Method 1: Using the FBR Website

Step-by-Step Instructions:

- Visit the official FBR website:

👉 https://www.fbr.gov.pk - Click on Iris 2.0 and you see new window

- Scroll Down and then you see different options click on “Active Taxpayer List (ATL)”

- Choose the tax year:

✅ Tax Year: 2024 (for ATL 2025 status) - Select the taxpayer type:

- Individual

- Company

- AOP

- Individual

- Enter your CNIC (for individuals) or NTN (for businesses) in the field provided (without hyphens or spaces).Fill captcha

- Click “Verify”.

You’ll instantly see whether your name is listed as an active taxpayer or not.

📱 Method 2: Check via SMS (No Internet Required)

If you don’t have internet access, follow these steps:

- Open your SMS app.

- Type:

ATL<space>CNIC

Example: ATL 3520212345678 - Send this message to 9966

- You’ll receive a confirmation message with your ATL status.

Common Issues When Checking ATL Status (And How to Solve Them)

Even if you have recorded your return, your name cannot be viewed at ATL. Why and how to fix here:

- 🔴 Issue 1: Late Submission

- Cause: You submitted a tax return after the due date.

- Solution: Consult FBR for a file, or late inclusion process before September 30, 2025 (cannot occur by avoiding punishment).

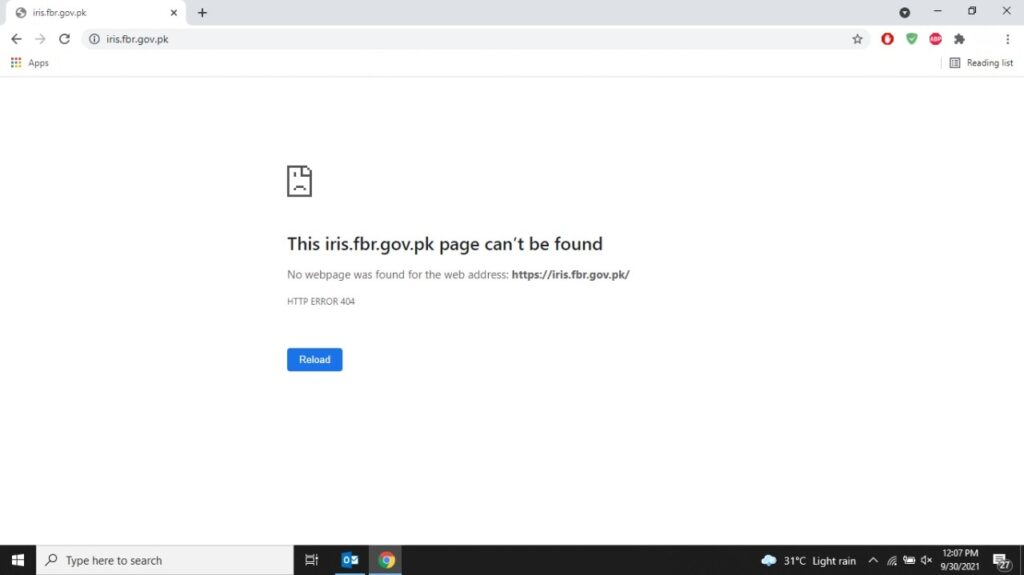

- 🔴 edition 2: return not sent correct

- Cause: Return was saved, but was not “presented” on the Iris portal.

- Solution: Log in to https://iris.fbr.gov.pk, go to “Draft”, and complete the submission.

- 🔴 Issue 3: Challan is not confirmed

- Cause: Skattebetalingen din (Challan) er bekreftet av banken/FBR.

- Solution: Check the payment status again in IRIS.

- 🔴 Issue 4: Incorrect CNIC or NTN format

- Reason: To insert CNIC with hyphens or invalid format.

- Solution: Always enter without any symbol or space.

- Results of not being at ATL

- Being absent from atl can spend more than just money.

- 🔻 Financial Penal Penal:

- Repeat prices on bank transactions

- Increased duties of procurement of properties

- High tax on vehicle registration

- 🔻 Legal and operational restrictions:

- Disqualification

- Boundary

- Further investigation by tax authorities

📅 Key Dates to Remember (ATL 2025 Timeline)

| Event | Date |

| Tax Return Filing Deadline | 30 September 2025 |

| ATL Updates | Every Monday |

| ATL 2025 Effective From | March 2025 |

| Valid Until | March 2026 |

💡 Additional Resources

- 🖥️ FBR IRIS Portal – https://iris.fbr.gov.pk

- 📄 ATL Weekly PDF – https://fbr.gov.pk/atl

- 📞 FBR Helpline – 051-111-772-772

📘 Taxpayer Facilitation Centers – Visit your nearest RTO office

Conclusion: Stay Informed. Stay Compliant

The active taxpayer list (ATL) is not just another government document – this is an important that unlocking economic freedom and reliability in Pakistan. Whether you are a student release, official professional or owner of the business, your responsibility and correct are.

👉 Develop a routine of frequently reviewing the ATL status and archiving returns annually prior to the deadline. It only takes a few minutes, but saves you thousands – literally.

📢 Call to Action

Do you require assistance with your tax return or want to verify your ATL status?

Contact MBS Tax Services Today

✅ Expert Filing Assistance

✅ FBR Registration & NTN

✅ Return Submission & ATL Monitoring

📞 WhatsApp: [0308-7543324]

🌐 Visit: [www.mbstaxaion.com]