Paying taxes and filing income tax returns is one of the most important financial responsibilities for individuals and businesses. While being a filer comes with legal recognition and benefits, it also has its own set of challenges. Similarly, choosing not to become a filer may seem convenient at first, but it carries long-term disadvantages that can affect financial, legal, and social aspects of life. Understanding these disadvantages is crucial for making informed decisions about financial management.

1: What Does It Mean to Be a Filer?

A tax filer is a person or business registered with the tax authorities who regularly submits income tax returns. This status allows individuals to access financial services, participate in business opportunities, and legally document their income. Being a filer is often mandatory for earning above a certain income threshold.

A non-filer, on the other hand, is someone who avoids registering as a taxpayer or fails to submit tax returns. While this may appear to reduce immediate obligations, non-filers face serious legal, financial, and social challenges.

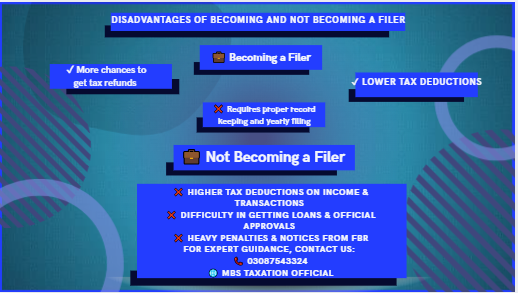

2: Disadvantages of Becoming a Filer:

Disadvantages of Becoming and Not Becoming a Tax Filer

While filing taxes is legally required and has long-term benefits, it comes with some disadvantages:

Financial Obligation:

Disadvantages of Becoming and Not Becoming a Tax Filer

Filing taxes requires paying taxes on your income according to established tax slabs. This reduces the disposable income available for personal use or investments.

Example: An individual earning PKR 1,500,000 annually may have to pay thousands of rupees in taxes. For someone managing a tight budget, this can feel like a financial burden.

Administrative Responsibilities:

Disadvantages of Becoming and Not Becoming a Tax Filer

Filers must maintain proper records, including income statements, receipts, invoices, and financial transactions. Managing this paperwork can be time-consuming and sometimes requires professional assistance.

Risk of Audit or Scrutiny:

Disadvantages of Becoming and Not Becoming a Tax Filer

Tax authorities may scrutinize the financial records of filers. Any mistakes or omissions can trigger audits, penalties, or even legal proceedings, which can be stressful and expensive.

Documentation Burden:

Disadvantages of Becoming and Not Becoming a Tax Filer

Keeping all relevant documents organized, especially for small businesses or freelancers, can be a challenging task. Lost receipts, miscalculated expenses, or incomplete documentation can create problems during tax filing.

2.5. Complexity of Tax Laws:

Disadvantages of Becoming and Not Becoming a Tax Filer

Understanding tax regulations and filing correctly requires knowledge or expert guidance. Many individuals find tax laws complex, which can lead to errors or the need to hire a tax consultant.

3: Disadvantages of Not Becoming a Filer:

Disadvantages of Becoming and Not Becoming a Tax Filer

Choosing not to become a filer may seem easier, but the disadvantages can have a far-reaching impact:

Legal Penalties:

Disadvantages of Becoming and Not Becoming a Tax Filer

Non-filers are legally liable to pay fines, penalties, or even face prosecution in extreme cases. Tax authorities are increasingly strict about enforcement, making non-compliance risky.

Limited Financial Opportunities:

Disadvantages of Becoming and Not Becoming a Tax Filer

Banks and financial institutions often require proof of tax compliance before issuing loans, credit cards, or other financial services. Non-filers may face higher interest rates or loan rejection.

Example: A non-filer applying for a home loan may be denied or may only qualify for a small loan at a higher interest rate.

Higher Withholding Taxes:

Disadvantages of Becoming and Not Becoming a Tax Filer

Non-filers are subject to higher withholding taxes on bank accounts, dividends, property transactions, and other financial activities. This reduces overall financial efficiency.

Difficulty Proving Income:

Disadvantages of Becoming and Not Becoming a Tax Filer

Non-filers may face challenges proving income for visas, rental agreements, or official documentation. Tax returns serve as an official proof of income for filers.

Limited Business Opportunities:

Disadvantages of Becoming and Not Becoming a Tax Filer

Many businesses, tenders, and government contracts require tax filing status. Non-filers are often excluded from these opportunities, reducing growth potential.

Social and Financial Credibility:

Disadvantages of Becoming and Not Becoming a Tax Filer

Being a non-filer may affect social and financial credibility. Business partners, clients, or lenders may view non-filers as unreliable or untrustworthy.

Accumulation of Future Liabilities:

Disadvantages of Becoming and Not Becoming a Tax Filer

Non-filing today can lead to compounding penalties and back taxes, creating a larger financial burden in the future.

4: Long-Term Impact Comparison:

Disadvantages of Becoming and Not Becoming a Tax Filer

| Aspect | Being a Filer | Not Being a Filer |

| Financial Obligation | Must pay taxes regularly | Higher withholding taxes, penalties |

| Legal Status | Compliant with law | Subject to fines, legal action |

| Financial Access | Easier to get loans, credit cards | Restricted access to loans or investments |

| Business Opportunities | Eligible for contracts, tenders | Often excluded from business or government opportunities |

| Social Credibility | Viewed as responsible and trustworthy | May be perceived as avoiding responsibilities |

| Documentation | Requires maintaining records | Difficult to prove income or financial status |

5: Real-Life Implications:

Disadvantages of Becoming and Not Becoming a Tax Filer

Consider a small business owner in Pakistan. If they become a filer, they can bid for government contracts, open corporate bank accounts, and access business loans. If they remain a non-filer, they face rejection for financial services, higher taxes on transactions, and potential legal consequences.

Similarly, an individual who files taxes regularly can easily apply for a car loan, provide proof of income for rental agreements, and maintain financial transparency. Non filers struggle with these simple tasks due to lack of documented proof of income.

6: Final Thoughts:

The decision to become a filer or not is more than a tax matter; it is a question of financial discipline, credibility, and long-term security. Being a filer involves effort, regular documentation, and tax payments. While this may seem burdensome, the benefits legal protection, access to loans, social credibility, and business opportunities far outweigh the inconveniences.

Non-filers may avoid paperwork or tax payments temporarily, but they face compounding disadvantages. Legal risks, higher withholding taxes, restricted financial access, and lost opportunities can affect both personal and professional growth. Over time, non-filing can become a major financial and legal problem, far more serious than the effort required to file taxes responsibly.

7: 3 Drawbacks of Being a Filer in Pakistan: Complete Guide:

Disadvantages of Becoming and Not Becoming a Tax Filer

So, you are eligible for tax in Pakistan, and you might be debating whether to file with the FBR or stay a non-filer. While being a non-filer can feel like an easy way out, becoming a filer has its perks and responsibilities. Filing is your badge of being a responsible citizen. But let’s be honest-there are a few disadvantages of being a filer in Pakistan.

The same goes for non-filers. So read on and find out what being a filer means for you and the challenges that come with it!

8:What is a Filer in Pakistan?

Disadvantages of Becoming and Not Becoming a Tax Filer

In Pakistan, a filer is a taxpayer who regularly submits their income tax returns to the Federal Board of Revenue (FBR). A filer can be an individual or organization. If you want to take the benefits that come under tax laws, then you have to first become a compliant taxpayer.

But being a filer in Pakistan also puts some responsibilities on your shoulders. First, you must file your annual income tax returns by the deadline. Make sure your submitted information is accurate and on time.

Paying the correct amount of tax is another vital duty. As a filer, you should calculate your dues carefully to avoid any nasty surprises during audits.

Likewise, filers must keep thorough records of their financial transactions and documentation. This organized approach is vital. Why? Because it is your evidence if questioned by the FBR.

Similarly, stay updated on tax laws and regulations. Well, you know, tax regulations often change, and ignorance is not an excuse.

Conclusion:

Disadvantages of Becoming and Not Becoming a Tax Filer

In conclusion, while becoming a filer may appear challenging due to administrative requirements and tax obligations, it is a proactive choice for financial stability, legal compliance, and personal credibility. Non-filing may offer short-term convenience but comes with serious long-term disadvantages, including penalties, financial restrictions, and social mistrust.

Being a filer ensures that individuals and businesses are legally compliant, financially credible, and prepared for future opportunities. Tax compliance is not just a duty; it is a strategic decision that safeguards long-term financial growth, protects against legal risks, and builds trust in personal and professional relationships.

Contact Us:

Disadvantages of Becoming and Not Becoming a Tax Filer

- Website: MBS Taxation

- Contact Form: Click Here

- WhatsApp: +92 308 7543324

- Facebook: MBS Taxation

We’re here to simplify your taxes so you can focus on what matters most—your work, business, and life!

FAQ:

Disadvantages of Becoming and Not Becoming a Tax Filer

What is a filer?

Disadvantages of Becoming and Not Becoming a Tax Filer

A filer is an individual or business registered with the tax authorities who regularly submits income tax returns. Being a filer helps in accessing financial services, participating in business opportunities, and legally documenting income.